Financial Mistakes: Buying the Money Pit Home

I’m sure everyone’s seen “The Money Pit”. If not, definitely go check it out; it’s an oldie but goody that many people can relate to. If you haven’t seen it, here’s the rundown: Walter Fielding (Tom Hanks) and his girlfriend Anna Crowley (Shelley Long) purchase a “distressed” mansion with plans to renovate. The plans go awry through a series of housing issues, from muddy plumbing to raccoon infestation, and the couple must sink into complete debt to repair (shall I say entirely reconstruct?) the home.

So where am I going with this? I’m not saying that every fixer-upper is a recipe for disaster. As you may remember, I’ve owned and remodeled two homes in need of repair. Many times, fixer-uppers can return thousands of dollars to you in sweat equity.

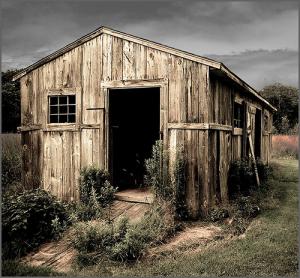

Rather, the point I think we should look at is that some houses are beyond repair. A house with many issues all lumped together (think foundation, plumbing, electrical and water damage) could end up costing more than it’s worth in return on your investment. Let’s look at ways to avoid the money pit more closely.

Get an Expert Opinion

First, let’s take a look at the potential purchase. When you buy your home, you should have a home inspection. Always. No matter if the house appears newly remodeled; some sellers might have patched a ceiling to hide a leaking roof. If you are not a professional home inspector yourself, it may be best to hire one to help you make your best choice possible.

Calculate Your Home Improvement Investment Dollars

Once the inspection is finished, you can begin to add up all the costs associated with fixing all of the issues. Say for example that the whole house needs new windows. Now is the time to figure out a ballpark range for their replacement. Once you have determined how much it will cost to fix everything, you can ask the sellers to reduce their sales price. Of course, asking does not guarantee that they will do so, but it doesn’t hurt to ask.

Saying Goodbye to a Might-Have-Been

If you need costly repairs on the home and the sellers won’t budge on the price, it may be time to walk away. It’s often not worth the time or effort to pour thousands of dollars into a home if it won’t net you some sweat equity. In other words, if the cost of purchasing the home and fixing it up will cost you more than it can later be appraised for, the purchase just might not be in the cards.

How Do I Know How Much It Can Later Appraise For?

Not sure how much the projected appraised value will be after all of your anticipated repairs? Check with the appraiser who first gave you a value for the home as is. If you give her a run-down of the repairs you wish to complete, she can let you know how much more she thinks the house will be worth.

When it’s all said and done, though, the final determining factor in your potential fixer-upper purchase may be a combination of financial projections and love. If you love the house, even in its tarnished state, the cost to repair may be worth it in the long run (even if you do have to battle a raccoon in your dumbwaiter).

- Login to post comments

-

YFS wrote:

Fri, 11/18/2011 - 01:21 Comment #: 1When you say beyond repair. Are you saying there is a home you will completely skip out on because of the renovations? Would you simply factor that into your purchase price?

Miss T wrote:

Fri, 11/18/2011 - 04:11 Comment #: 2Great advice. You definitely need to know what you are getting yourself into when it comes to purchasing a money pit. You don't want to bite off more than you can chew. Research is key and so is setting realistic timelines and priorities. Don't expect yourself to finish redoing the house in one year. It won't happen.

Kris @ Everyday Tiups wrote:

Fri, 11/18/2011 - 14:18 Comment #: 3You just made me remember how Shelley Long tried to become a movie star!

I always feel terrible for people when they buy a home that has issues so much greater than anticipated. Getting a great home inspector is so important. Thing is, when you are starting out and don't know anything yet, it is hard to know who is a great home inspector vs. someone that is just going through the motions.

Everyone needs a Mike Holmes nearby (from Holmes vs Homes)

MoneyCone wrote:

Fri, 11/18/2011 - 15:20 Comment #: 4If you've never done this before, this is where the experience of someone who has managed to fix and resell comes in very useful.

Always, ask around. The costs of fixing a home can spiral very quickly if not properly appraised.

Amanda L Grossman wrote:

Sun, 11/20/2011 - 16:31 Comment #: 5Sounds like I need to see that movie!

Christa Palm wrote:

Mon, 11/28/2011 - 18:25 Comment #: 6YFS, I classify houses as beyond repair when the issues are extensive. For example, if a $100,000 home would cost more money to repair than it would be ultimately worth, I consider that "beyond repair". At that point, bulldozing the house and rebuilding would be a better option, provided the buyer could purchase the property at only the lot price.

Miss T, very true about the length of time to remodel. I was never good at estimating a project's timeline; thankfully, my husband could usually nail it on the head.

Kris, wouldn't it be nice to have a Mike Holmes in every neighborhood? My bank actually recommended a great inspector in my area, so I was lucky to find my "Mike Holmes" here!

MoneyCone, great tip to ask around and get multiple quotes. It's amazing how much construction costs can vary.

Amanda, it is a great movie!